David Tepper Portfolio

Appaloosa LP Holdings

David Tepper is a US-American hedge fund manager who became the world's best-paid one in 2009, earning $4 billion dollars that year alone. Before he founded the company Appaloosa Management in 1992, he worked for Goldman Sachs.

David Tepper's investment strategy prioritizes technology and innovation, as evidenced by his top stock holdings. Meta Platforms Inc (FB), known for its dominant social media platforms like Facebook and Instagram, is a core investment in Tepper's portfolio, reflecting confidence in the company’s long-term growth despite recent market volatility.

Tepper also invests in Amazon.com Inc (AMZN), demonstrating belief in the e-commerce giant's expansive business model that includes cloud services, artificial intelligence, and an increasing presence in physical retail. This aligns with trends of continual online shopping growth and cloud infrastructure demand.

Microsoft Corporation (MSFT) occupies another significant position in the investor's selections, showing trust in its diversified product mix from operating systems to cloud computing through Azure, which continues to compete robustly against other tech giants.

NVIDIA Corp (NVDA), a leader in graphics processing units (GPUs) important for gaming, professional visualization, data centers, and AI applications, adds technological depth to Tepper's investments. NVIDIA's pioneering role in these sectors supports expectations of sustained performance.

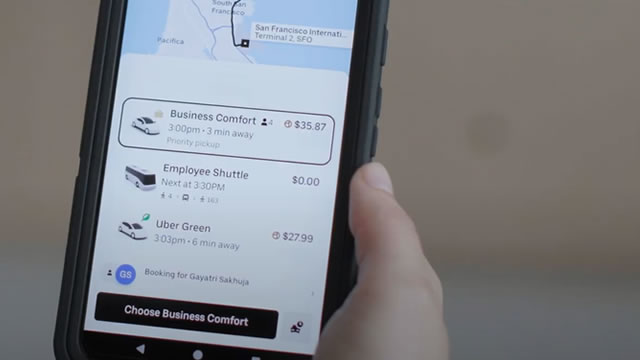

Finally, Uber Technologies Inc (UBER), representing the app-based mobility sector in the portfolio, reflects Tepper's penchant for innovative business models with disruptions potential in traditional markets. Notwithstanding short-term uncertainties, this indicates foresight into the future of transportation and delivery services.

Potential investors evaluating David Tepper's approach will discover a focus on technological transformation and platform leadership, strategic cornerstones poised for enduring demand. The inclusion of these stocks—Meta Platforms, Amazon, Microsoft, NVIDIA, and Uber—in Tepper's carefully curated portfolio underscores a commitment to resilient companies likely to shape economic landscapes ahead.

$5.98 Billion

Total portoflio value