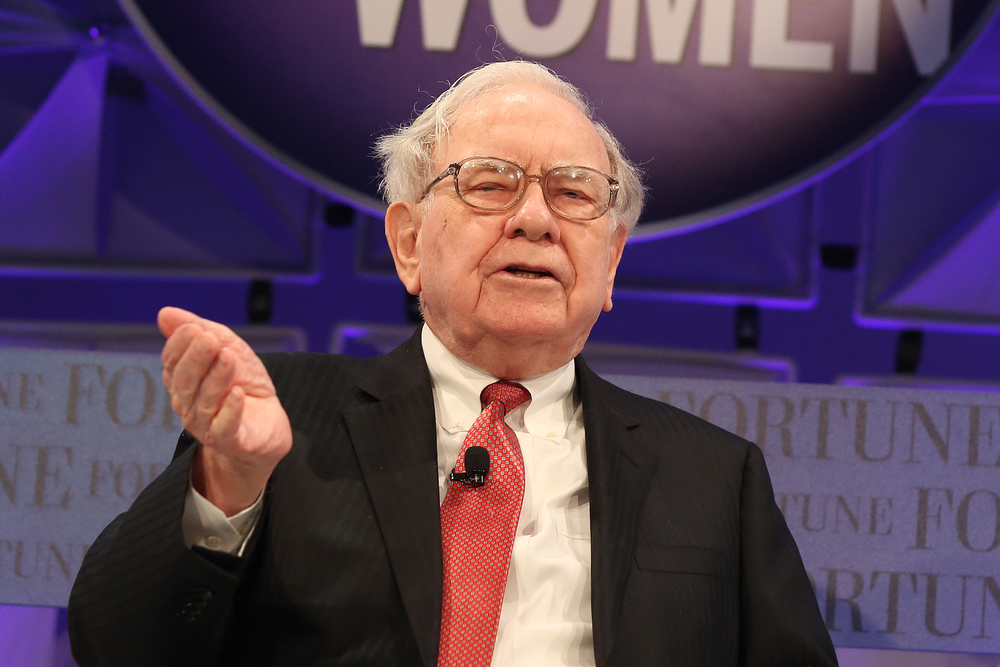

Berkshire Hathaway's Kroger Stake

Warren Buffett acquired 50 Million Kroger shares worth $3.56 Billion. That's 1.40% of their equity portfolio (12th largest holding). The investor owns 7.44% of the outstanding Kroger stock. Warren Buffett started to build up the position in Kroger in Q4 2019 and continued to invest until Q2 2021. Since then they sold 11.8 Million shares. The stake costed the investor $1.61 Billion, netting the investor a gain of 122% so far.

News about Kroger Co. and Warren Buffett

This Ridiculously Cheap Warren Buffett Stock Could Make You Richer

Kroger stock has outperformed the market during the past five years. It pays a strong and growing dividend.

A Buffett Shopping List: 7 ‘Oracle of Omaha’ Stocks to Consider.

With the market presenting some mixed signals, now may be the time to consider the best Warren Buffett stocks for the circumstances. Put another way, certain...

5 Warren Buffett Stocks Other Billionaires Are Loading Up On

In this piece, we will take a look at five Warren Buffett stocks other billionaires are loading up on. For more Warren Buffett stocks, head on over to 10 War...

Warren Buffett reduces stake in Kroger

One of the world’s best-known investors, Warren Buffett, has sold some of his large stake in Kroger Co.