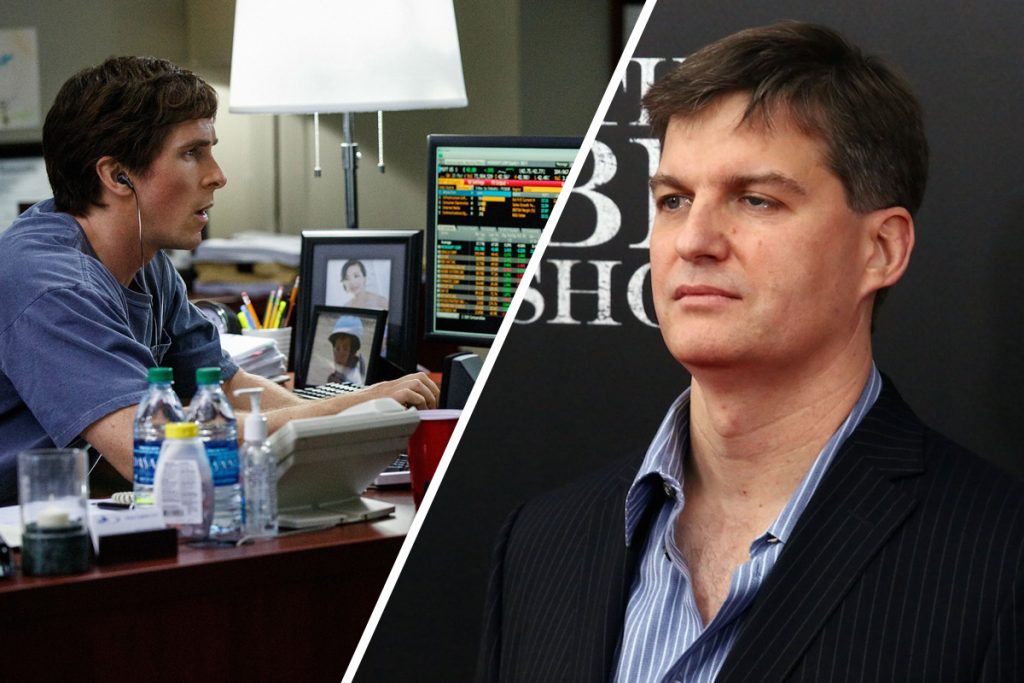

Dr Michael Burry is a Legendary investor known for predicting the housing bubble & subsequent financial crisis of 2008.

Popularised in the movie “the Big Short” Burry bet the Housing Market would crash & made a killing for himself & the investors of Scion Capital. See about Michael Burry section for more on this.

Michael-burry-the-big-short Movie played by Christian Bale.

Contents:

A. Why is Michael Burry Investing into Water?

B. How has Michael Burry Invested into Water?

C. Is Burry Buying Almond Farms?

D. Bill Gates Buying Farmland

E. How can you invest into Water?

F. Best Farmland REIT’s

G. Best Water Funds & ETF’s

H. Top 5 Water Stocks to Invest into?

A. Why is Michael Burry investing into WATER??

Water? It falls from the sky & 70% of the earth’s surface is covered in it! So why invest into a commodity so abundant?

Well, it turns out FRESHWATER (which is the important stuff we need to live) only represents approximately 2.5% of the total water available! According to National Geographic.

Caption: illustrations by Kent Hernandez for Doha Debates

In addition, only 1% of freshwater is classed as easily accessible.

As 99% of water is trapped inside glaciers & ice caps! Breaking the numbers down further, only 0.007% of mother earths water is available easily to hydrate the worlds growing population of 7.7 billion. Source: World bank

Supply and Demand

This is all about supply & demand, we have a short supply of freshwater & a growing demand!

The result is increased value of fresh Water & thus water stocks & funds in the industry.

How much is the demand for Water?

According to the United Nations:

Water use has grown at more than double the rate of the world’s population increase over the past 100 years. By 2025, it is estimated 1.8 billion people will live in areas prone to major water scarcity & 2/3rds of the world’s population will be living in water-stressed regions!

B. How has Michael Burry Invested into Water?

Big Short Investor Burry has preferred investing into water rich farmland, which is usually protected from many major government limitations.

Michael Burry Investing into Farmland. Source: Motivation2Invest.com Edit (original Image: Seedworld.com)

Burry stated in an interview:

“What became clear to me is that food is the way to invest in water. That is, grow food in water-rich areas and transport it for sale in water-poor areas”

This is the method for redistributing water that is least contentious, and ultimately it can be profitable, which will ensure that this redistribution is sustainable” – Source. NY Mag

Feeling lazy? Watch a Video Version of this post below

Fun Fact: Legendary investor Warren Buffett’s son is a real life farmer! He works full time on his farm & pays his dad Buffett rent which is tied to his weight! Warren’s idea is to incentivize his son to get healthier.

Howard Buffett, Warren Buffett’s son is a real life farmer. Source: Bloomberg

C. Burry Buying Almond Farms?

Michael Burry has reportedly been investing into ALMOND FARMS, he hasn’t gone nuts (hopefully) it’s all about SUPPLY & DEMAND.

DEMAND for Almonds?

According to the Washington post, Almonds have now taken over peanuts to become the most popular nut (actually a seed) in the USA.US Citizens now consume more than 10 times more almonds than they did in 1965.

Almond Milk Products have increased in popularity. Source: Foodbev.com

Why are Almonds becoming more popular?

This has been driven mainly by trends towards plant based foods & eating less dairy. Almond Milk was even reported to be outselling regular milk in some stores! According to my research & sources. The Guardian Newspaper in the UK even ran a story called “White gold”

Almond Farming (Pexels.com)

Supply of Almonds?

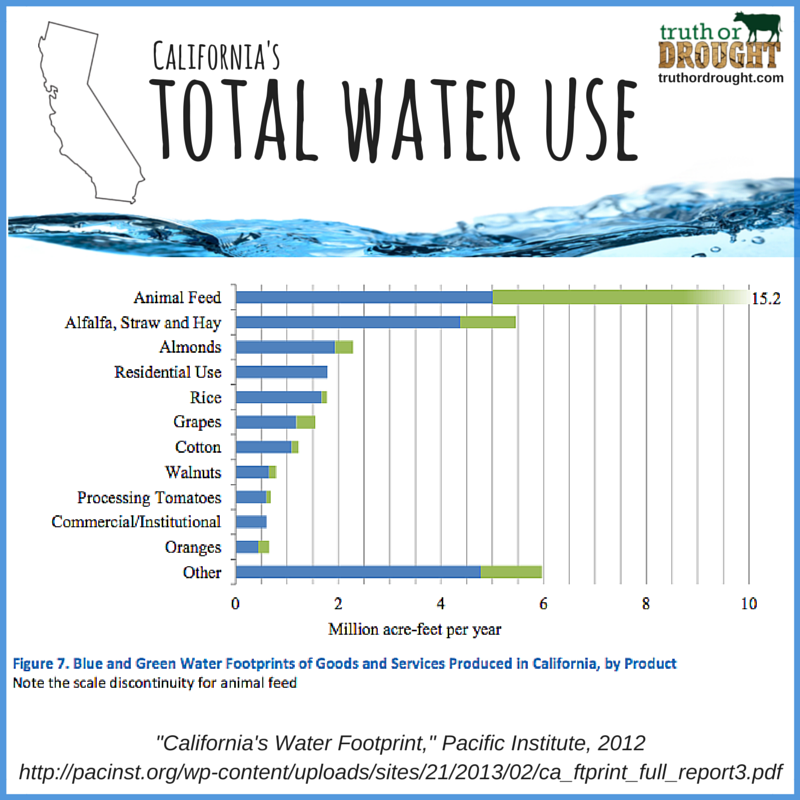

Almonds take alot of water to grow. According to Pennsylvania Earth Science Association:

To grow just one almond requires 1.1 gallons of water, and to grow a pound takes 1,900 gal/ lb of almonds.

However, despite alot of misconceptions online, most other nuts such as hazelnuts, pistachios, walnuts ,and cashews all us a similar amount of water.

Almond supply and Water Use. Source: Truthordrought.com

D. Bill Gates Buying Farmland?

Michael Burry isn’t the only big investor buying farmland. Farmland has also been a favourite investment of Warren Buffett (& even his son (Howard Buffett) owns a farm!). In addition, Bill Gates has been buying up lots of farmland & is now the largest private farmland owner in the USA.

I covered this in a previous video, on my Youtube Channel, I will link to below.

E. How Can You Invest into Water?

Method 1. Farmland REIT’s

You can follow the Billionaires & invest into Water Rich Farmland directly, but for most retail investors this isn’t easy, so I recommend REIT’s.

A REIT (Real Estate Investment Trust) is a trust which owns property. This could be commercial Real Estate, Warehouses & in this case farmland.

The great thing about REIT’s is they can be traded just like stocks (Highly Liquid). They also pay a regular dividend payment ( which can be very high, 5%+) .

Bill gates investments Farmland Agriculture stocks. Source: https://www.youtube.com/watch?v=wh-g_p3yy_0&t=69s

(Bill Gates is now the largest owner of private farmland: Source: Motivation 2 invest youtube.

Equity REITs vs DEBT REIT’s:

Equity farmland REITs pool their cash to purchase entire farmland sections and then rent them out to farmers.

Whereas, Debt farmland REITs make loans to farmers, which they can use to to buy more land or expand operations.

Generally speaking, equity REITs are usually more volatile than debt REITs. For a few reasons, the main one being there is much more certainty with debt REIT returns.

Disclaimer: This is NOT Financial Advice to buy or sell any security, please do your own research, due diligence & seek independent financial advice if required.

Best Farmland REITs?

Farmland REIT’s are a great defensive investment with upside potential to “Harvest” great returns, here are my top 2 below.

1. Gladstone Land (Ticker: LAND)

Gladstone owns 115 farms with approximately 90,000 acres of land across the US. This land is diversified across 10 different states in the US & with an exceptional 100% occupancy rate!

Gladstone pays out monthly dividends to investors and has a current dividend yield of 2.56%, the stock also tends to appreciate well. They have also recently acquired a Citrus Grove in South Florida.

Gladstone land REIT. Financial Details. Source: Cheaper Than Guru

Gladstone Land REIT share price peaked at 136% in 2021, from Low’s in 2020. One Guru investor currently has shares, Ken Griffin from Citadel, Short Squeeze anyone?

2. Farmland Partners (Ticker: FPI)

Another Favourite is Farmland Partners, This REIT is 30% smaller than LAND with a market cap of approximately $400 million.

They IPO’d in 2014 and now owns over 150,000 acres of land across the US. Most of the farms are located in the corn belt, southeast US, and California.

Farmland Partners has a dividend Yield of 1.54% and a 1 year return of an incredible 104%!

Want Early Alerts before big stock moves?

Join our email list & subscribe to our Youtube channel. Motivation 2 invest.

Method 2. Water Funds (ETF’s)

Another easy way to invest into Water like Michael Burry is to invest into an Index fund of Water stocks, or an ETF (Exchange Traded Fund).

1. First Trust Water ETF (FIW)

This is the best-performing water ETF based on performance over the past year!

- 1 Year Returns (trailing): 51.2%

- Expense Ratio: 0.54%

- Annual Dividend Yield: 0.41%

2. Invesco Water Resources ETF (PHO)

Invesco Water Resources ETF is a multi cap fund which tracks the Nasdaq OMX US Water Index.

This fund focuses on companies which create products to conserve or purify water. Examples include, water utilities, infrastructure, materials and water equipment businesses.

Surprisingly this fund also includes Machinery stocks, which make up nearly a third of assets!

- 1 Year Returns (Trailing): 47.3%

- Expense Ratio: 0.57%

- Annual Dividend Yield: 1.11%

Invest into Water, Water Shortage coming?, Source: elefobiotech.com

Method 3. Invest into Water Stocks

There are a variety of water stocks to invest into, but here are my top 5 water stocks, these stocks are top holdings in many of the water funds above.

1. American Water Works Company Inc. (AWK)

An all American classic, the public water utility company. Founded in 1886, the company today has over 7100 employees.

- Revenues: $3.8 Billion (Year to date)

- Market Cap: $32 Billion

- PE Ratio: 39

- Dividend Yield 1.55%

American-water-works-co-inc. Best Water Stocks to buy

2. Danaher Corp (DHR)

Danaher Corporation is a globally diversified conglomerate headquartered in Washington, D.C.

The company designs & manufactures professional, medical, industrial, and commercial products and services.

This is a top 3 holding in two of the most popular Water ETF’s previously mentioned.

- Revenues: $26.7 Billion (Year to date)

- Market Cap: $232 Billion

- PE Ratio: 43

- Dividend Yield 0.26%

Danaher best Water Stocks to buy

3. Waters Corp. (WAT) – Growth stock potential.

Waters Corp is an analytical laboratory instrument and software company, founded in 1958.

Out of many defensive stocks on this list, Waters Corp is more of a GROWTH STOCK. With Growth rate last quarter of over 30% the company also has high Return on capital (32%) , a Strong balance sheet (current ratio 2.4) and lots of momentum showing on the technical charts.

- Revenues: $26.7 Billion (Year to date)

- Market Cap: $24 Billion

- PE Ratio: 34

- Return on Capital: 32% (Fantastic)

- Growth Rate: 32%

Water corp, Best Water Stocks to Invest into

4. Agilent Technologies Inc. (A)

Agilent Technologies is a leading manufacturer of analytical instruments. The company was established in 1999 as a spin-off from Hewlett-Packard.

Agilent focuses its products and services on six main markets: food, environmental, pharmaceutical, diagnostics, chemical and energy.

Agilent Celebrates reaching it’s environment goals. Source: Agilent Technologies.(Newsdirect.com)

- Revenues: $26.7 Billion (Year to date)

- Market Cap: $52 Billion

- PE Ratio: 36

- Return on Capital: 14% (good)

- Growth Rate: 7%

5. Xylem Inc (XYL)

Xylem is a leading water technology provider to many industry sectors from residential, commercial & of course agriculture.

- Revenues: $5.2 Billion (Year to date)

- Market Cap: $23.9 Billion

- PE Ratio: 41

- Return on Capital: 8% (ok)

- Growth Rate: 16%

Final Thoughts?

The Investing thesis behind Water, is driven by supply & demand. The Smart Money has jumped at this opportunity for a defensive play with upside potential.

Thirsty for more?

Sign up to our email list to be informed when Legendary Investors are buying & selling stocks.

- Michael Burry is Investing into Water | 3 Ways you can too? - September 28, 2021

- Is Michael Burry Still Short Tesla Stock? - September 28, 2021

- Has Michael Burry Shorted Bitcoin? 3 Ways to short sell crypto? - September 28, 2021